Uncomplicating Car Insurance

with our certified POSP

advisors to guide you

Life Insurance

A life insurance plan is a contract between the life insurance company and the policyholder in which the company promises to pay a pre-determined sum amount to the nominee in case of death of the policyholder or after the maturity of the policy, in return, the assured need to pay a premium amount for a certain time. Some life insurance companies in India also offer optional rider coverage such as accidental rider, critical illness riders, etc. A life insurance policy ensures the financial security of the family of the assured in case of an unforeseen event.

The benefits of buying a life insurance policy are more than just providing financial security to the family of the insured. A life insurance policy can help individuals to get tax benefits on the life insurance premiums paid and the benefits received under the life insurance policy. A life insurance plan can also be used as collateral for a loan.

There are various types of life insurance plans available in India and each plan has its own benefits and features. A life insurance policy helps the policyholders to secure the financial future of their family and loved ones in their absence. Hence, we cannot ignore the importance of life insurance in ensuring the financial security of loved ones.

Types of Life Insurance Plans

There are various types of life insurance available in India. The following are the different types of life insurance plans available in India:

Term Insurance

Term insurance is the most simple and basic type of life insurance plan. It is also known as a “pure protection plan”. A term insurance plan provides a death benefit to the policy’s nominee/beneficiary if the life assured dies suddenly during the policy term. This type of plan provides financial security to the family and loved ones in case of the absence of the policyholder.

Whole Life Insurance

Whole life insurance remains active till the policyholder is alive (up to 100 years of age). If the policyholder dies during the policy term, the insurer pays the sum assured under whole life insurance to the nominee of the policy. If the policyholder survives till the age of 100 years, the insurer pays the matured endowment coverage to the policyholder in the form of maturity benefit.

Endowment Life Insurance

Endowment plans are also known as traditional life insurance plans. It is a combination of savings and a life insurance plan. An endowment plan helps the policyholder to save his fund regularly to get the lump sum amount on the maturity of the policy. This maturity benefit is paid to the insured if they survive the entire policy tenure. In case of demise of the life assured during the policy term, the life insurance company provides the sum assured to the beneficiary as the death benefit of the policy.

Child Protection Plan

A child insurance plan is a combination of life cover and investment plan. It secures multiple stages of your child’s future. The plan offers a lump sum amount at the end of the policy term and this amount can be used for your child’s education and marriage.

Retirement Plan

The retirement plan is also known as a pension plan. It is a combination of investment and life insurance plans. A retirement plan or pension plan helps you to secure your post-retirement life financially. This plan helps you to get regular income even after retirement and helps you to become financially independent to enjoy post-retirement life.

ULIP Plan

The unit-linked investment plan is a combination of an investment and life insurance plan. This plan is specially designed for wealth creation and life protection. This plan invests your money in market-linked funds (stocks, bonds, mutual funds, etc). Generally, ULIP plans are flexible and transparent allowing you to customize your plan as per your needs and requirements.

Money-Back Plan

The money-back plan is a combination of both insurance and an investment plan. Under money back plan, the policyholder gets regular payouts every 5 years as a survival benefit. These regular payments are usually equal to some percentage of the sum assured amount.

Key Features of Life Insurance Policy in India

Life is uncertain and the only way to deal with this uncertainty is to be prepared for them. To avoid such uncertainties, you can buy a life insurance policy that provides financial protection to your family and your loved ones in your absence. A life insurance plan is not just a tool that provides financial protection, it has many other features that one needs to understand before buying a life insurance policy in India. Below mentioned are the key features of the life insurance policy in India:

Death Benefits

In case of an untimely death of the life assured during the policy term, the nominee will receive a death benefit, which will help your financial dependents to fulfill their daily needs and life goals.

Investment option

A life insurance policy can be used as an investment option, if you invest in ULIPs, Endowment and Money Back plan as these type of life plans provide dual benefits of life cover and investment.

Tax Exemption

You can also save your income tax with the help of a life insurance policy. Under sections 80C and 10(10D) of the Income Tax Act, 1961, you can avail of income tax benefits by buying a life insurance policy.

Flexibility in payments of the premium

A life insurance policy offers flexibility in premium payment. You can pay your life plan premiums on a monthly, quarterly, half-yearly, or yearly basis. You can choose your premium payment mode and frequency under the life insurance plan.

Maturity Benefits

Life insurance policies offer maturity benefits if the policyholder survives the policy term. The life insurance company will provide a sum assured to the policyholder as a maturity benefit at the end of the policy tenure.

Collateral for Loan

Some life insurance policies offer a loan against a policy facility that can help the policyholder meet immediate financial needs, such as medical bills or loan repayment, etc.

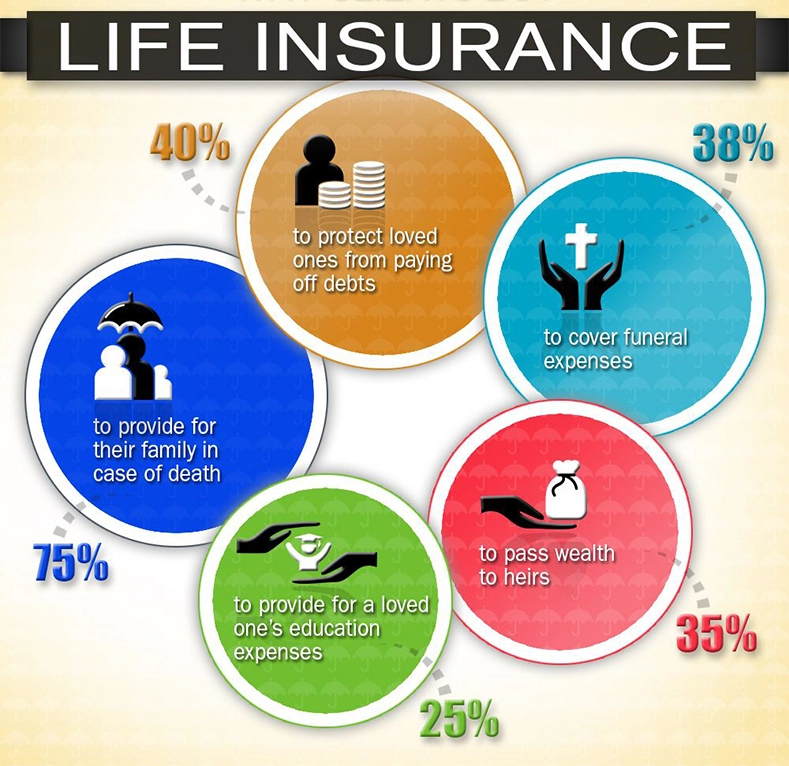

Benefits of Life Insurance policy

A life insurance policy provides financial protection to the family in case of the sudden death of the policyholder. It helps the policyholder to financially secure the future of their loved ones and also gives them a way to save their earnings for a better future. There are various benefits of buying a life insurance policy in India. Below mentioned are the benefits of buying a life insurance plan in India:

Financial Protection

Life insurance provides financial protection to loved ones. Life insurance act as a financial shield for the family of the policyholder.

Financial Stability

A life insurance policy can help in securing the financial security of your loved ones in the future. A life insurance plan pays a death benefit to the nominee in the event of the death of the insured, which can help the family to clear debt or other responsibilities and maintain their standard of living.

Retirement planning

Life Insurance policy can be very useful at the time of your retirement and provides you financial support and makes you financially independent post-retirement.

Tax Benefits

Section 80C of the Income Tax Act allows you to deduct up to Rs. 1.5 lakh in life insurance premium. Additionally, if the premium is up to 10% of the sum assured or the sum assured is at least 10 times the premium amount of the life insurance plan, then the income is eligible for tax exemption under section 10(10D).

Loan Facility

A life insurance policy allows you to take a loan at a low-interest rate to meet immediate financial expenses. With the help of a life insurance plan, the assured can enjoy a substantial amount of liquidity. You can avail of loan facilities by investing in ULIPs, endowment plans, and child plans.

Best Life Insurance policy in India 2022

Buying a life insurance policy can be a daunting task for the customers as many life insurance companies are offering various life insurance plans in India. We “RenewBuy” have done some extensive research and made a list of “Best Life Insurance Policy in India”. The table below lists the best life insurance policy in India.

| S.no. | Company name | Plan Name | Plan type | Max. Sum Assured |

|---|---|---|---|---|

| 01 | HDFC Life Insurance | Click 2 Protect Life | Term Insurance | No Limit |

| 02 | Max Life insurance | Smart Secure Plus | Term Insurance | 1Cr |

| 03 | ICICI Pru Life Insurance | iProtect Smart | Term Insurance | No Limit |

| 04 | Bajaj Allianz Life Insurance | Smart Protect Goal | Term Insurance | 1Cr |

| 05 | Edelweiss Tokio Life Insurance | Simply Protect | Term Insurance | No Limit |

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different life insurance companies

Insurance Companies offered Life Insurance Plans

Below mentioned is the list of the Life insurance companies that offers life insurance plans in India:

| S.no. | Company name | Claim Settlement Ratio 2020-2021 | Solvency Ratio |

|---|---|---|---|

| 01 | Life Insurance Corporation of India (LIC) | 98.62 | 1.66 |

| 02 | HDFC Life Insurance | 98.01 | 1.99 |

| 03 | SBI Life Insurance | 93.09 | 2.33 |

| 04 | ICICI Prudential | 97.93 | 2.13 |

| 05 | Max life | 99.35 | 2 |

| 06 | Bajaj Allianz | 98.48 | 7.16 |

| 07 | Kotak Mahindra | 98.50 | 2.97 |

| 08 | Aditya Birla Sunlife | 98.04 | 1.77 |

| 09 | Tata AIA | 98.02 | 2 |

| 10 | India First | 96.81 | 1.76 |

| 11 | PNB Met life | 98.17 | 1.96 |

| 12 | Canara HSBC OBC | 97.10 | 3.19 |

| 13 | Reliance Nippon | 98.49 | 2.28 |

| 14 | Exide life | 98.54 | 2.17 |

| 15 | Bharti AXA | 99.05 | 1.83 |

| 16 | Star Union | 95.96 | 2.30 |

| 17 | Future Generali | 94.86 | 1.72 |

| 18 | Shriram | 95.12 | 2 |

| 19 | IDBI Federal Ageas Federal Life | 95.07 | 3.37 |

| 20 | Pramerica life | 98.61 | 4.19 |

| 21 | Aviva | 98.01 | 2.41 |

| 22 | Aegon | 99.25 | 2.58 |

| 23 | Sahara | 97.18 | 9.11 |

| 24 | Edelweiss Tokio | 97.01 | 2.2 |

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different life insurance companies

How to choose the best Life Insurance Policy?

With so many life insurance plans in the market, choosing the best life insurance policy in India can be very difficult. Everyone needs to know that based on what factors you should measure the life insurance policies available in India. We “RenewBuy” has made a list of a few pointers that will help you choose the best life insurance policy in India.

Claim Settlement Ratio

First of all, you should check the claim settlement ratio of the insurance company. Life insurance companies with a high claim ratio will be the best to settle your claims when the time comes.

Sum Assured Amount

Check the sum assured amount offered under the life plan. Always go for a plan that offers a high and more sum assured option.

Customer Reviews

Customer reviews are the best ways to pick your life insurance plan. These reviews are posted by people who have the experience of how good is the particular plan.

Compare plans

Compare the different life insurance plans based on their coverage benefits. Life insurance companies have revolutionized their policies and are offering value-added features that enhance the benefits of the policy. Check for these value-added benefits so that you can choose the best life insurance plan for yourself.

What are the Life Insurance Riders & Its Benefits?

Life insurance riders are additional riders that enhance the basic coverage benefits offered under the base policy. There are different types of riders offered by life insurance companies, and each rider comes at an additional premium rate. You can choose to add the desired riders by paying an additional premium and making your coverage comprehensive. Some of the most common riders available with life insurance plans are as follows –

| Ride Name | Coverage Offered |

|---|---|

| Accidental Death Benefit Rider | The nominee will receive the sum assured amount along with some additional benefits by the life insurance company if the life assured dies in an accident. |

| Accidental Total and Permanent Disability Rider | In case of total or permanent disability due to an accident, all future premiums are waived off, and the insurance company pays some predefined amount to the policyholder. |

| Critical illness Rider | This rider covers specific critical illnesses. If the assured suffers from any of the critical illnesses listed in the policy document, then the insurance company pays a predefined sum amount to the policyholder and allows the policyholder to take the treatment without worrying about the finances. |

| Term Rider | This rider offers monthly income to the nominee on the death of the life assured. |

| Waiver of Premium Rider | This rider waives off the future premiums if the insured suffers permanent disablement due to an accident. |

| Surgical Rider | This rider pays the hospital expenses of the policyholder, if they undergo an avoidable surgery in India |

Factors Affecting Life Insurance Premium

We have mentioned in the table below the factors that are considered by the life insurance company in India and that affect the life insurance premium:

| Factors | How They Affect Life Insurance Premiums |

|---|---|

| Age | The older you are the higher would be the premium |

| Sum Assured | The higher the sum assured you choose the higher would be the premium |

| Type of policy | The premium amount is different for the different types of life insurance plans. |

| Coverage benefits | The coverage benefits of a policy also change the premium. If the policy has inbuilt and comprehensive coverage benefits, then the premium of the policy will be a bit high. |

| Height and Weight | Your height and weight determine your BMI. If your BMI is higher or lower than the ideal, then you have to pay a high premium. |

| Medical History | If you have any existing medical complications or illnesses, then your premium might increase. |

| Family History | If you have a family history of illnesses or diseases, the premium might rise because such illnesses or diseases might be genetic and increase your mortality risk. |

| Occupation | If you are engaged in a dangerous occupation, the premium would be high. For example, people in the defence forces, police, politics, etc. are charged higher premiums. |

| Location | If you live in an area that is prone to natural disasters, the premium would be high. |

| Lifestyle Habits | Premiums are higher for individuals who smoke and/or consume alcohol and other intoxicating substances. |

| Riders selected | Life insurance plans to allow optional coverage benefits called riders. Each rider incurs an additional premium and so if you opt for any rider, the premium will increase. |

| Policy Discounts | Life insurance plans also allow premium discounts for different reasons. If you qualify for the discounts, the premium will be reduced. |

How to Buy Life Insurance Policy From RenewBuy?

RenewBuy provides a quick and trusted platform where customers can compare and buy the best life insurance policy for themselves. Below mentioned are the steps to buying the best life insurance plan:

- Visit the official website of Insure Now.

- Scroll down and click on the “Life” section.

- Fill in the required information such as DOB, Gender, etc.

- The next page will show you the Life Insurance policy in India offered by various insurers”.

- You can choose one of them and proceed with the payment.

- Once the payment is done, the policy document will be shared with you at your registered E-mail ID.

Customers can also buy the life insurance policy from RenewBuy POSP advisors through our mobile application.

Documents required to Buy Life insurance Policy

The following are the documents you need to submit to buy the best life insurance plans in India:

ID Proof

Voter ID, Driving License, PAN Card, Passport, or Aadhar Card.

Age Proof

10th or 12th mark sheet, Driving License, Passport, Birth Certificate, Voter ID, etc.

Address Proof

Telephone Bill, Ration Card, Electricity Bill, Driving License, and Passport.

Income Proof

Form 16, ITR (2-3 years), salary slips for the last 3 to 6 months, etc.

Life Insurance Claim Process

Life Insurance claim process is classified into two categories i.e. death claim process, and the maturity claim process. Let’s discuss both the process in detail.

Death Claim Process

- Nominee should intimate the Life Insurance Company with all the required detail such as cause of death, time, and place.

- Submit all the needful documents such as the death certificate, and claim form.

- Submit the hospital, post-mortem, and doctor’s report.

- Once the insurance company completes its investigation, the insurer will settle the claim within 30 days of the documents being submitted by the insurer.

Maturity Claim Process

If the policyholder survives the policy term, then the insured is eligible to get benefits of maturity benefits. Below mentioned are the steps to file a maturity claim:

- The life insurance company will send a discharge voucher to the policyholder.

- The insured has to sign the voucher along with the original policy bond and send it back to the insurance company.

- The life insurance company will settle the claim and the claim amount will be sent to the assignee.required documents